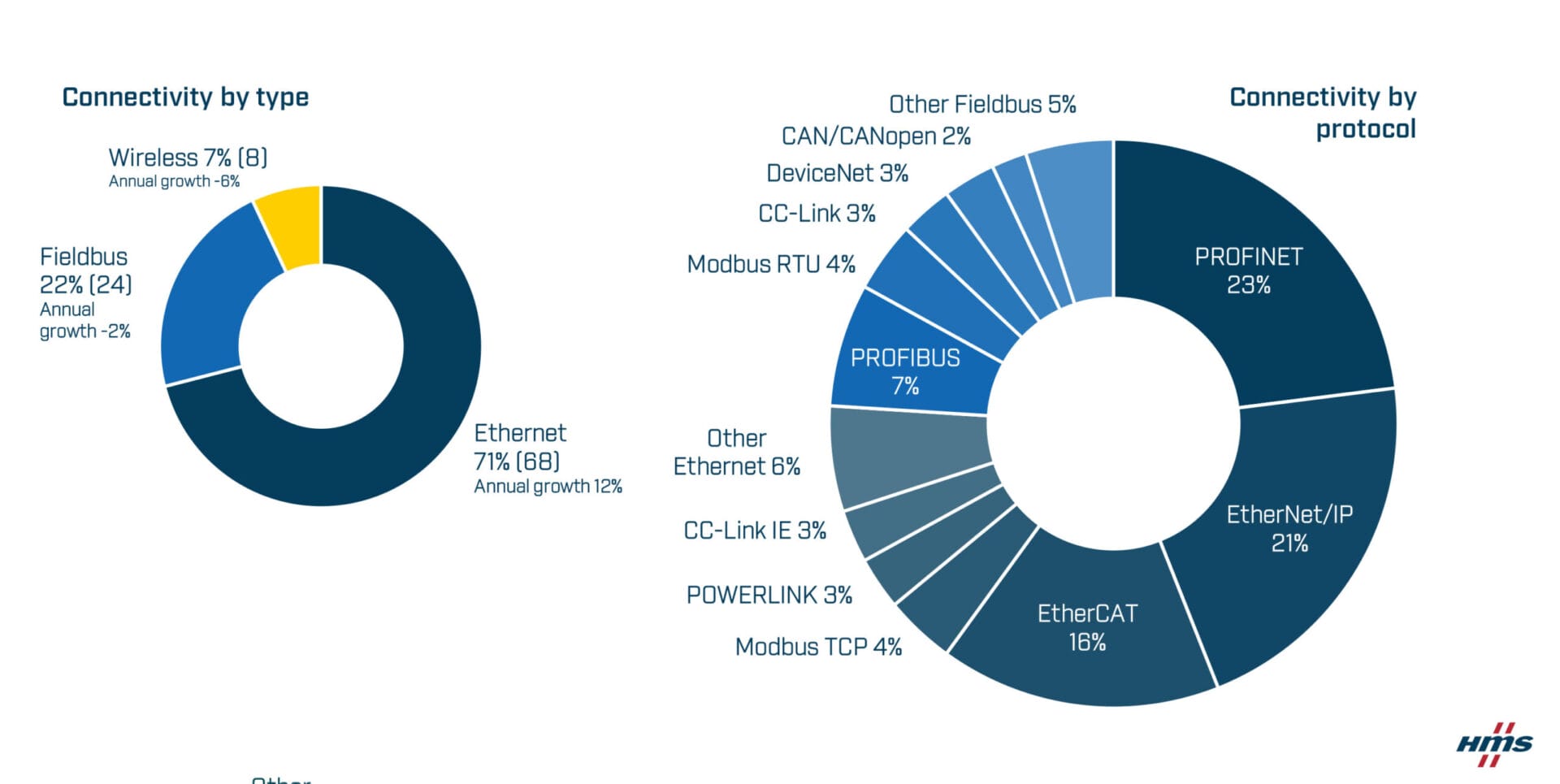

Every year, HMS Networks conducts a comprehensive analysis of the industrial network market, aiming to estimate the distribution of new connected nodes by type and protocol within factory automation. The latest study indicates that the industrial network market continues to expand, with an anticipated 7% growth in 2024. Notably, Industrial Ethernet remains the dominant player, representing a substantial 71% of all newly installed nodes (compared to 68% last year). Meanwhile, fieldbuses have declined to 22% (from 24%), and wireless technologies have seen a slight dip from 8% to 7%. Among the top contenders, PROFINET account for 23% of newly installed nodes, followed closely by EtherNet/IP at 21%, and EtherCAT now stands at 16%.

Market shares 2024 according to HMS Networks – fieldbus, industrial Ethernet and wireless.

In the 2024 study, HMS concludes that the industrial network market continues to grow, with total market growth in 2024 expected to be +7%, confirming the continued importance of network connectivity in factories.

Industrial Ethernet Shows Steady Growth

Growing by 12%, Industrial Ethernet accelerates its growth and continues to capture market share. Industrial Ethernet now accounts for 71% of the global market for newly installed nodes in factory automation (compared to 68% last year). PROFINET is the largest protocol, with a market share of 23%, surpassing EtherNet/IP, which accounts for 21% of new nodes. The popularity of EtherCAT remains strong and is now securely in third place with a 16% market share.

Fieldbuses Experience Expected Decline

Traditional serial fieldbus installations continue to lose momentum. While fieldbus installations still constitute a significant portion of new nodes added, annual growth is expected to drop by -2% in 2024. PROFIBUS leads the fieldbus rankings with a 7% market share, followed by an even distribution among other well-known fieldbus protocols.

Together, fieldbuses account for 22% of the market in 2024. Despite the decline in new fieldbus nodes, many devices, machines, and factories will continue to rely on these well-functioning and proven fieldbuses for years to come.

Wireless Technologies Maintain Steady Presence

Wireless technologies have seen steady growth in recent years, although the pace of growth is now reported to have slightly decreased. Wireless solutions still comprise a robust 7% of the total share by type. The market continues to introduce more products with support for industrial wireless, and acceptance of wireless solutions in factory settings is on the rise. Typical use cases include cable replacement applications, wireless machine access, and connectivity to mobile industrial equipment.

Industrial networking is key for productivity and sustainability in manufacturing

“Connectivity is now standard in factory automation, with Industrial Ethernet leading the way. However, as we look ahead, we anticipate a dynamic landscape with emerging trends and technologies. While Industrial Ethernet currently dominates, we’ll witness exciting changes and innovations that will shape the future of industrial networking.” – Magnus Jansson, Product Marketing Director at HMS Networks, Business Unit Anybus.

Scope:

The study includes HMS’ estimation for 2024 based on number of new installed nodes within Factory Automation. A node is defined as a machine or device connected to an industrial field network. The presented figures represent HMS’ consolidated view, considering insights from colleagues in the industry, our own sales statistics and overall perception of the market.