Spokesperson, Phil Brown, Sales Director at Fortress Technology Europe

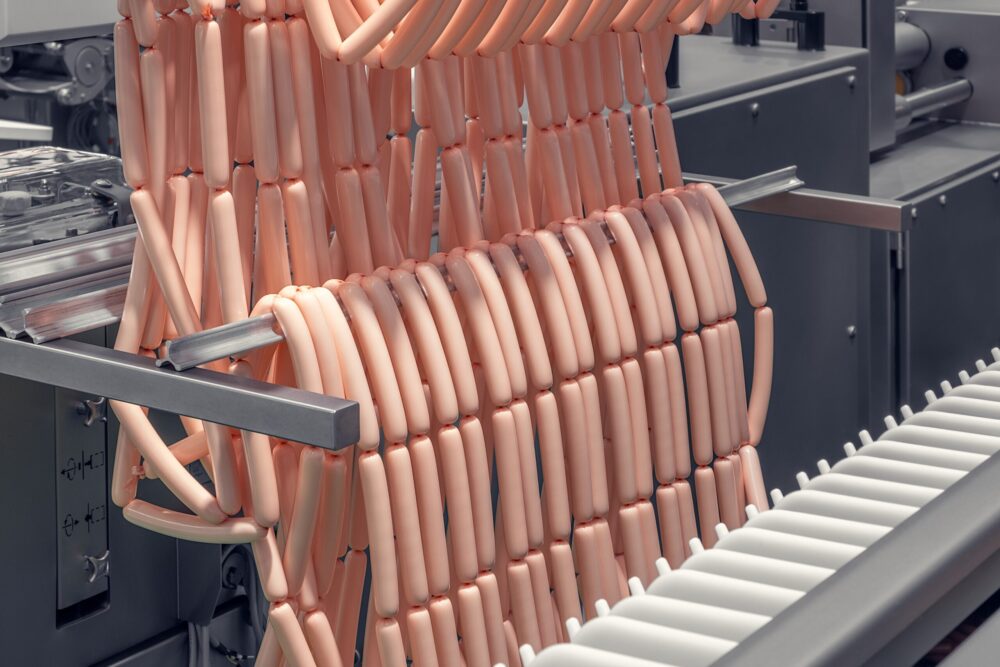

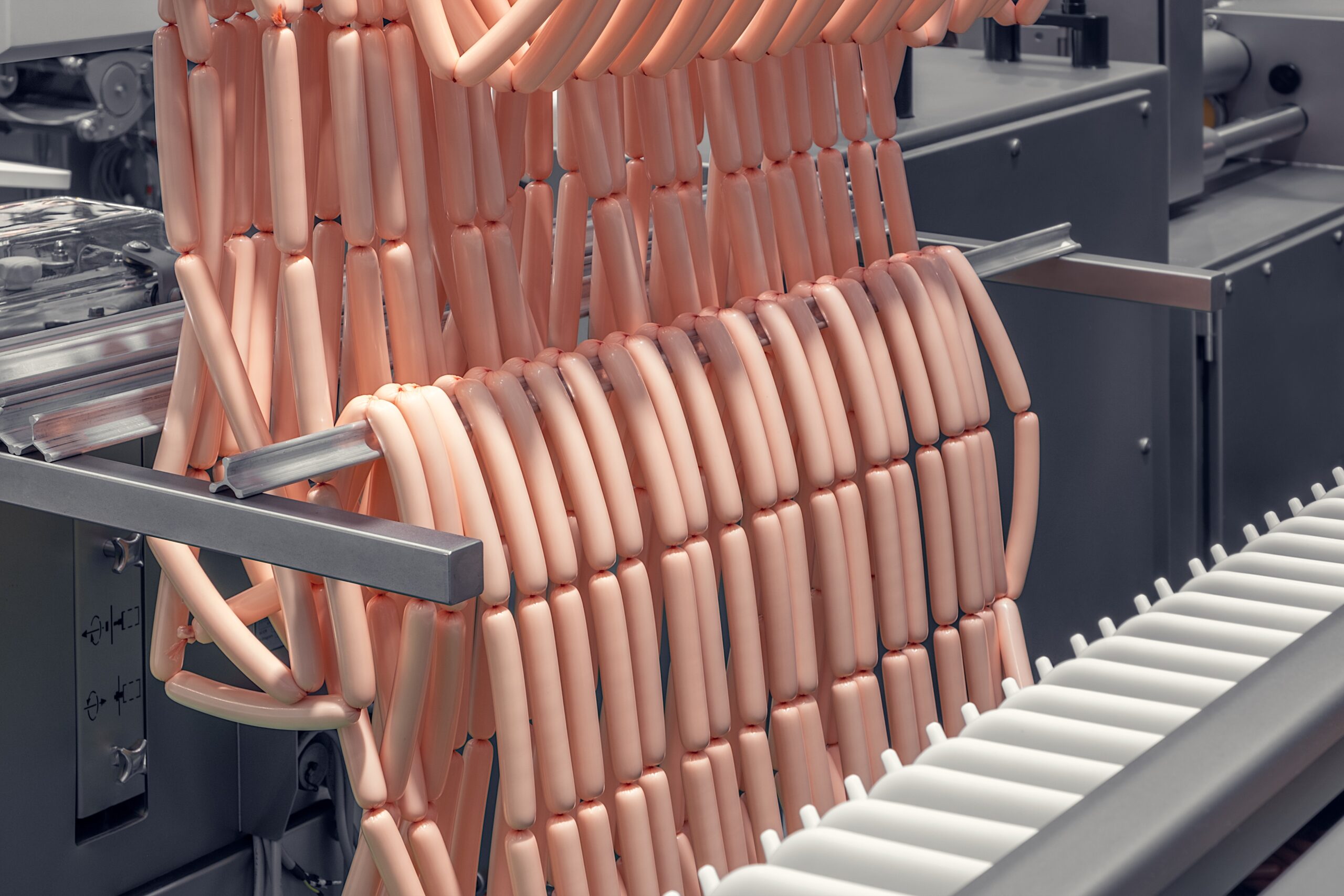

Over the last decade, two opposing diet trends have significantly risen in popularity: poultry meat and plant-based meat alternatives. For any food manufacturer, increasing and expanding production to adapt to these consumer demands creates new, and sometimes diverse, inspection challenges.

Food safety specialist Fortress Technology explores the ongoing protein boom and how companies can ensure consumer health and hygiene is prioritised.

In an effort to combat diet-based health risks, many consumers are switching out overly-processed foods for high-protein, low-fat, nutrient-rich products. In an online survey, around half of consumers said ‘healthy eating’ is a personal priority and they are eager to reduce consumption of processed foods, sugar, fat, salt and, for some, red meat. In the United Kingdom, health, reducing consumption of artificial ingredients and sustainability also featured highly on the list of changes to eating habits suggests a McKinsey Insights report on conscious eating[i].

Leaner meat, especially chicken, has gained popularity in the last decade. Simultaneously, the meat-alternatives market continues to steadily grow, with many big meat conglomerates now investing in plant-based protein lines. Typically, these food manufacturers are seeing an upsurge in demand for new and exciting product applications. Fortress Technology highlights the importance of manufacturers reviewing current CCPs and safety controls as their facilities expand and production lines diversify.

PROTEIN-RICH PICKINGS

Poultry is the most consumed livestock commodity in the world. According to the British Poultry Council, the average person in the UK consumes more than 35kg of chicken meat annually. This accounts for approximately 50% of UK meat consumption.

Fitness and diet culture have played a large role in heightened demand for poultry products. Scientific research suggests a diet rich in high-quality, lean protein is a beneficial strategy to preventing and treating obesity, as well as building muscle mass. In the UK, chicken is now the favoured meat option, accounting for over 50% of all meat sales. Much of this can be attributed to its high protein-per-gram ratio and cost effectiveness when compared to red meat.

Another high-protein obsession, initiated by the bodybuilding world and fuelled by headlines, articles and social media, is protein-fortified foods. Supermarket shelves are now stacked with products containing added protein, from yoghurts and shakes to cereals and bagels.

Currently 79 million people globally identify as vegans, and many seek meat and dairy substitutes with higher protein content. Even environmentally-conscious consumers are jumping on this ‘protein boom’ bandwagon. Driven by growing consideration about the impact meat production has on the planet, consumers are switching to plant-based meat alternatives. In 2022, the European retail market for plant based foods surged to €5.8 billion, up by €1 billion in two years.[ii]

Metal is the most likely contaminant to be introduced during cutting and deboning poultry products due to the prevalence of automation and stainless steel equipment.

MARKET SET TO DOUBLE

Measuring USD 10.37 billion in 2022, by 2032 the global protein market it is expected to reach around 23.34 billion USD.[iii].

This rapid expansion in the meat and meat-alternative market has naturally increased the amount of product passing through a single facility. When new equipment, processes and production lines are introduced, recalls and food safety threats multiply, prompting the need for additional control measures.

“Once a food facility has developed and implemented its HACCP food safety plan, it must be periodically evaluated in order to ensure compliance with standards and regulations. The plan must be analysed again if there are any changes within the facility that might increase or introduce a food safety hazard,” highlights Phil Brown.

POULTRY POPULARITY

In the UK, skinless breast remains the most popular chicken cut. This is predominantly attributed to its versatility and low fat content. As poultry processors add more of this product into their stock, the potential risk of physical contaminants during the cutting, trimming and deboning stage of production increases. Metal is the most likely contaminant to be introduced during this stage due to the prevalence of automation and stainless steel equipment. In addition, when equipment and surfaces deteriorate over time, they can present a possible contamination risk.

Regular food safety audits are integral to any management system. Poor record-keeping and non-compliance with established food safety plans are some of the top reasons food manufacturers fail audits.

These issues can be prevented by being strategic when selecting high-contaminant-risk checkpoints and inspection equipment on protein processing lines. Whenever there is a change in a process or packaging, risk professionals should revisit inspection protocols and hypothetical contamination scenarios to look at potential holes in the value chain.

With higher volumes of product passing through a metal detector or X-ray system, there may also be more opportunities for food safety hazards to be mismanaged. To overcome this issue, when a facility introduces additional inspection equipment, existing and new operating staff should be properly educated, trained and assessed on the standard equipment testing procedures.

Adding upstream metal detection in a pipeline format can assist processors to mitigate the risk of metal contaminants in products like protein patties or vegan sausages.

HIGH SAFETY STAKES

It is common for processors with fast-growing operations to target food safety hazards with multiple CCPs. One longstanding Fortress customer and protein processor reports that by including both upstream and end-of-line metal detection, they reduced costs attributed to good product waste, time and labour by 50 percent.

Where there might appear to be a need for multiple machines to manage increased upstream output, Fortress recommends closely examining available options and speaking with their inspection system provider about the best system for their application. They can offer insights into various inspection systems and provide guidance on maximising system benefits, such as saving factory floor space, cutting operational costs and enhancing process efficiency.

Currently, plant-based burger patties and sausages are a vegetarian and vegan staple. However, trends change. Predicting the future popularity of current ‘consumer-favourite’ food products is always challenging. Given these rapid shifts, it is important for processors to remain diligent when identifying hazards and CCPs, no matter how large or how quickly their production line is expanding.

Phil flags that cutting corners on food safety is when non-compliance and brand-damaging contamination recalls are most likely to occur. “An annual HACCP assessment – a requirement for all meat, poultry and protein facilities – will help to ensure that all essential inspection points are effectively managed and, most importantly, that they are retail and food-service compliant.”

[i] https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/hungry-and-confused-the-winding-road-to-conscious-eating

[ii] NielsenIQ plant-based data, 2020 to 2022

[iii] https://www.precedenceresearch.com/protein-market#:~:text=In%20recent%20years%2C%20the%20protein,natural%2C%20and%20sustainable%20protein%20sources.