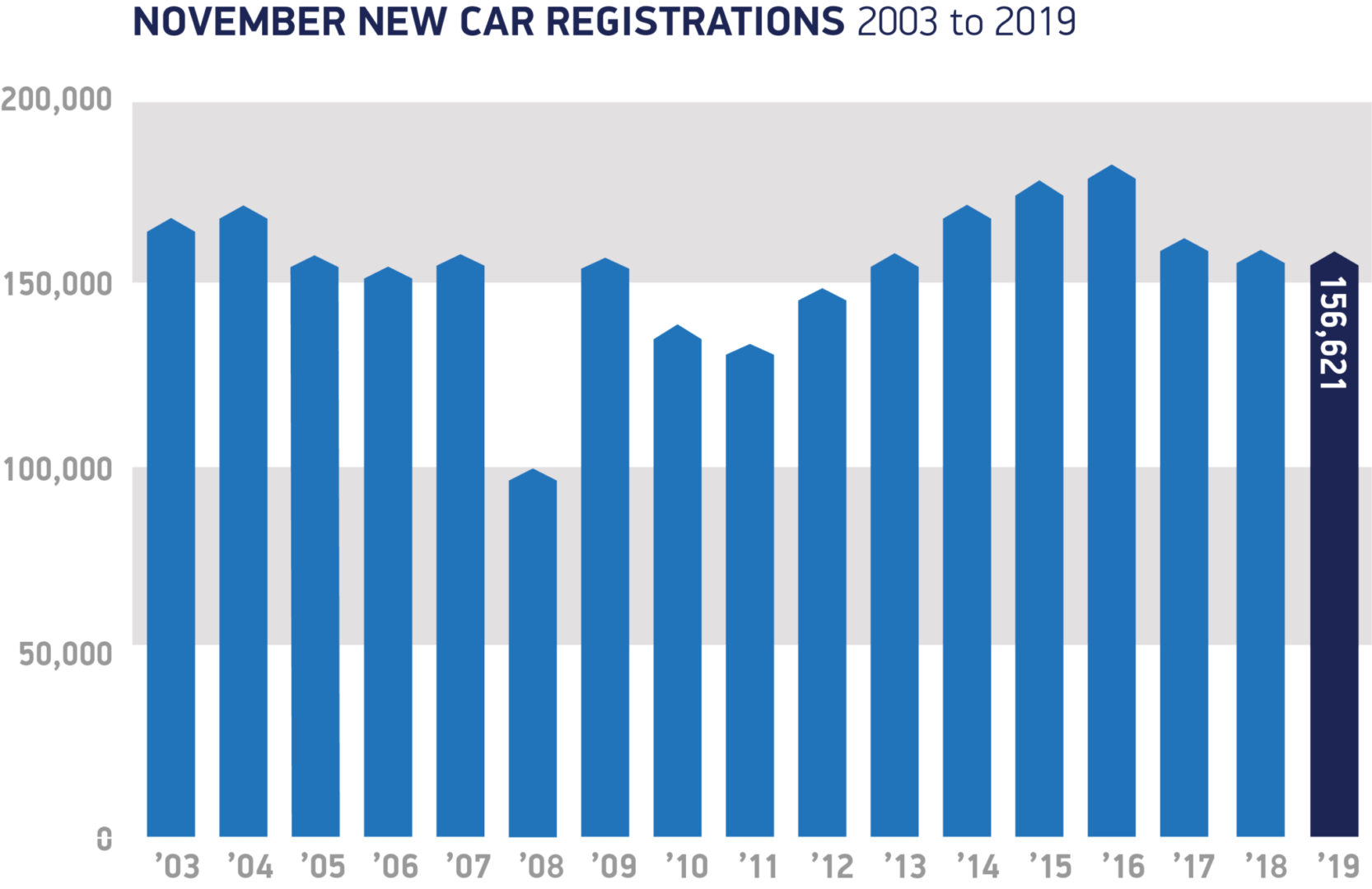

- UK new car market falls -1.3% in November with 156,621 models registered.

- For second consecutive month, alternatively fuelled vehicles reach record market share of 10.2%.

- Market performance year-to-date down -2.7% with 2.2 million cars registered for UK roads.

Thursday 5 December, 2019 The UK new car market fell -1.3% in November, with 156,621 models registered, according to figures released today by the Society of Motor Manufacturers and Traders (SMMT). This maintains the downward trend for new car registrations throughout 2019, as multiple factors, including weak business and consumer confidence, economic uncertainty and confusion over diesel and clean air zones, combined to affect demand.

In November, the decline was driven primarily by weak private demand, registrations down -6.1%, while the business market also fell, down -3.2%, but fleet registrations fared better, up 2.8%. For the second consecutive month, total alternatively fuelled vehicle (AFV) registrations reached a record market share, with more than one in 10 cars joining UK roads either hybrid, plug-in hybrid or pure electric – equivalent to 16,052 cars.

Demand for the latest battery electric cars surged by 228.8%, with 4,652 registered, while the markets for plug-in hybrids and hybrids also rose by 34.8% and 15.0% respectively. Elsewhere, petrol grew 2.0%, taking the lion’s share of all registrations (62.2%), as diesel fell -27.2%. Year-to-date, the overall UK new car market is down -2.7%, with 2.2 million cars registered, in line with current industry forecasts.

Mike Hawes, SMMT Chief Executive, said, “These are challenging times for the UK new car market, with another fall in November reflecting the current climate of uncertainty. It’s good news, however, to see registrations of electrified cars surging again, and 2020 will see manufacturers introduce plenty of new, exciting models to give buyers even more choice. Nevertheless, there is still a long way to go for these vehicles to become mainstream and, to grow uptake further, we need fiscal incentives, investment in charging infrastructure and a more confident consumer.”