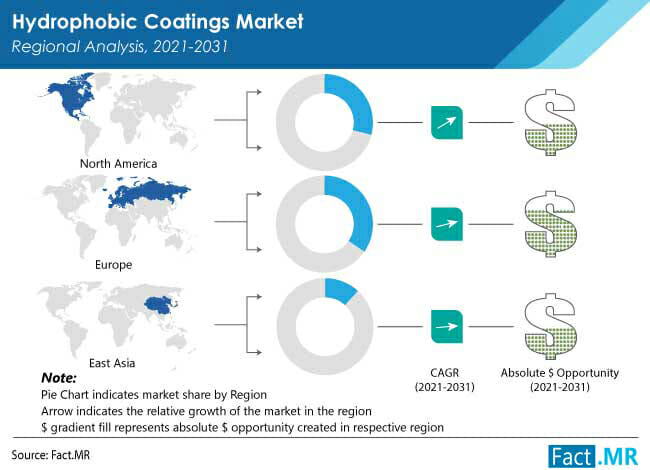

An ESOMAR-certified market research and consulting firm’s recent projections on the global hydrophobic coatings market reveal a positive albeit modest outlook, with an anticipated CAGR of above 5% across the 2021-2031 forecast period.

Increased demand for waterproof automobile coatings as well as technological advancements that allow nanoparticles to be incorporated into hydrophobic coatings because of their superior durability and huge surface area will boost the industry’s size.

The Asia Pacific region is a significant shareholder in the global market, accounting for around 1/3 of overall market revenue in 2020. Due to rising usage in marine, aerospace, automotive, and building & construction industries, as well as abrasion, water resistant, corrosion resistant, organic and inorganic pollutant defiant properties, hydrophobic coatings are witnessing growth in terms of adoption rate, especially in in developing regions.

Key Takeaways from Market Study

- Sales of hydrophobic coatings to reach 14 thousand tons by 2031

- The market in the U.S. is estimated to witness sales of 2.9 thousand tons in 2021

- Competitive intelligence of leading manufacturers and distributors highlights the competitive scenario across geographies.

- The concrete segment, under classification, is projected to record above 4% CAGR through 2031

- The market in Asia Pacific is forecast to witness sales of 2 thousand tons by 2031

“Hydrophobic coatings are used in a variety of industries, including construction, aerospace, automotive, and medicine. The market will expand steadily over the years as construction and automotive industries in developing economies increase output in parallel to the expansion and growth of various sectors,” says a Senior Research Analyst.

Competitive Landscape

The hydrophobic coatings landscape witnessing numerous mergers and acquisitions. Many new market competitors have entered the business in addition to organizations that are already operating in this space. R&D spending is being done to introduce new technologies into the mainstream market. Presence of a multitude of players renders the landscape quite fragmented.

- In March 2019, PPG announced that it had completed the acquisition of Whitford Worldwide Business, an international supplier of low-friction and non-stick coatings for industrial and consumer items.

- Aculon Inc. and Henkel Company struck a strategic collaboration agreement in October 2018 to bring NanoProof® PCB Waterproof Technologies to key mobile device manufacturers.

These insights are based on a report on Hydrophobic Coatings Market by Fact.MR.