According to a new market intelligence study by an ESOMAR-certified market research and consulting firm, the global market for container handling equipment is expected to increase at a value CAGR of 4.2% over the forecast period, to reach a market surpass US$ 2 Bn by 2031.

Historically, between 2016 and 2020, sales of container handling equipment surpassed US$ 1.5 Bn by the end of 2020. Due to COVID-19, transportation around the world was halted. Restricted movements by the government around the globe slowed down the growth of container handling equipment.

The increasing number of new terminals and the advent of automation is one of the most prominent trends in the container handling equipment market. As container terminals aim for higher productivity and more efficient operations, automation is making significant strides across the globe.

In order to meet the challenges of larger vessels and taller cranes the automated solutions will get adopted by port terminals. Automation of ports not only shrinks the turnaround and waiting time for container handling equipment but also cuts the container handling duration. Manufacturers of container handling equipment are focusing on reducing carbon emissions due to stringent rules and regulations.

Key Takeaways from Market Study

- By propulsion, electric/hybrid container handling equipment sales to soar, expanding at around 4% CAGR

- Automated stacking cranes demand to experience substantial growth, generating over 40% revenue

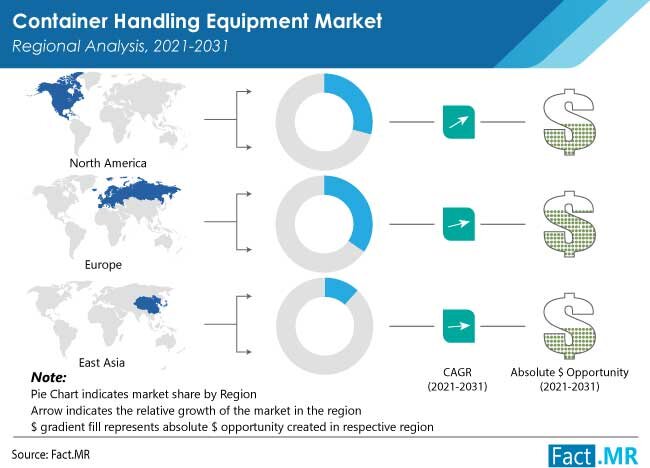

- U.S market to expand at a CAGR of 2.4%, attributed to increasing port infrastructure development

- U.K to account for over 1 out of 5 sales of container handling equipment in Europe

- East Asia to generate a total incremental opportunity of about US$ 176.5Mn

- South Asia likely to generate US$ 280 Mn incremental opportunity through 2031

“Higher productivity, better operations and consistent efforts at reducing emissions are driving the container handling equipment industry to new heights” says a Senior Research Analyst.

Competitive Landscape

Prominent container handling equipment manufacturers profiled in market intelligence report include Liebherr, Hyster-Yale Materials Handling Inc., Cargotec Corp, Konecranes, SANY and Kalmar among others. Prominent expansion strategies include forging strategic partnerships, launching new products and expanding existing production capacities.

- In 2019, Sany Heavy Industry Co., Ltd. partnered with ANGST Group and VCE (Vienna Consulting Engineers) ZT GmbH to form a joint venture called Palfinger Structural Inspection GmbH (STRUCINSPECT).

- Likewise, in the same year, Konecranes acquired one of largest crane service companies in Italy, Italian Trevolution Service SRL, specializing in crane modernizations, repairs, maintenance, spare parts and hoists, and components.

These insights are based on a report on Container Handling Equipment Market by Fact.MR.